Beginning of this year, there were great expectations for Airline Industry.

- An increase in passenger volume from 4.59 Billion (2019) to 4.72 Billion (2020)

- An increase in revenue from $838 Billion (2019) to $872 Billion (2020)

- An increase in net profit from $$25.9 Billion (2019) to $29.3 Billion (2020)

- Assuming a slight increase in economic growth and stable fuel prices, a 2% positive growth in Cargo was also predicted in 2020 (which was -3.3% in 2019)

But, a unique viral pandemic, COVID-19 originated in Wuhan, China has been devastatingly hitting the whole equation, projections and roadmap of Airline Industry. Covid-19’s unique capabilities to infect exponentially through close contact has been leveraged by highly flamboyant travel culture facilitated by airlines across the world. The virus carried by infected passengers reached all the continents and in those countries with inherent weaknesses in the health administration, the pandemic already caused severe causalities.

The ruling governments in countries, (rightfully) taken travel ban as the most important measure to control the outbreak; though this late realization and response has already caused the damage. The Airline industry will be the top affected one as the increasing travel ban has not only taken an unexpected hit on current revenue, but also has severe negative effect on revenue projections due to outweighed cancellations over forward bookings.

Some existing rules like EU’s rule “requiring airlines to run most of their scheduled services or else forfeit landing slots” has already caused severe revenue loss to airlines by flying “ghost flights” with “no passengers boarded”. The authorities are thinking of putting moratoriums on such rules though.

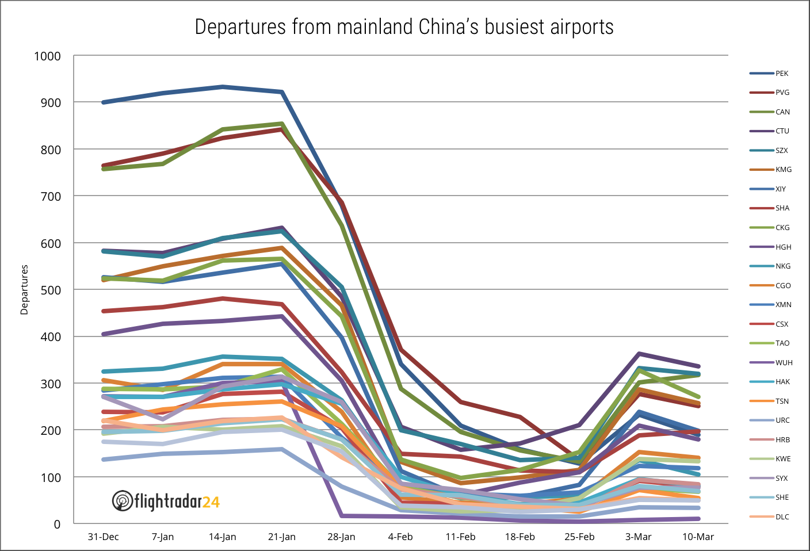

All world’s major airports and hubs show exponential rates of flight cancellations since last week of February; including Hartsfield-Jackson, Heathrow, Changi etc. The travel bans are increasing day by day and human awareness of “self quarantine” force he airlines to cancel their flights due to absence of passengers. We are currently in a state of highest capacity reduction in airline’s history.

The Covind-19 situation will be the highest crisis ever for the Airline industry , for sure. This has multi-folded impacts which do not confine to airline industry alone.

- The projections made (given above) at the beginning of 2020 all look fancy numbers now. As I write this, there is no tentative period of recovery from this grave situation. The testing of vaccine has started yesterday but the clinical trails would take 6 to 8 weeks and subject to many more hurdles. Even though a vaccine is introduced by mid of May, 2020, it highly unlikely that , Governments lift the ban due to the disastrous situation they had faced to control the viral spread.

- The steep decline of crude prices definitely has positive impacts on Jet fuel but the present situation has completely wiped off whatever benefits Airlines would have enjoyed from it.

- Majority of the airlines have financed the aircrafts through operating leases, bank loans or other such measures which they need to pay off from their revenue. Covid-19 puts high risk on this.

- Airlines would struggle to meet their operating expenses from April onward. The three major global alliances – Star Alliance, Oneworld and SkyTeam which represent around 60 airlines in the world have already called out to the Governments and to extend the support to them , “to survive”.

- The Air Travel industry including airports, GHAs, Software Service providers, Infrastructure service providers, ancillary service providers etc all are going take a severe hit due to this.

- The tourism industry would take the worst hit ever after Air Travel because of the very nature of virus avoidance measure which is “Social Distancing”. The impact is still being measured. It will go to billions globally.

While Airlines have sought support from governments for survival, quite naturally, many of the planned IT Spend and corresponding initiatives would be either postponed or cancelled. The aid from governments (if that happens) would be spent to meet opex rather than on initiatives due to prioritization. We shouldn’t be surprised if we see large negative impacts on Software Service providers revenue in 2020. Obviously, while struggling to exist, no airlines would dare to try out fancies. It won’t be surprising if disinvestment happen in many areas including AI, Robotics and Analytics where majority of the innovation budget has been planned.

Data Courtesy : IATA, Wired.uk, Statista, Economictimes, FlightRadar24